Fund Tools and Machinery Without Heavy Upfront Cost

Plan Equipment Financing Nationwide

You need trucks, machinery, or specialty gear to grow your business, but tying up working capital in a single purchase limits flexibility. Equipment financing in Lake Worth FL spreads payments over time, letting you preserve cash flow while adding capacity. Alternative Lending Services LLC works with businesses in Lake Worth across construction, transportation, service trades, and hospitality, delivering fast approvals, simple documentation, and flexible payment terms that align with your revenue cycle.

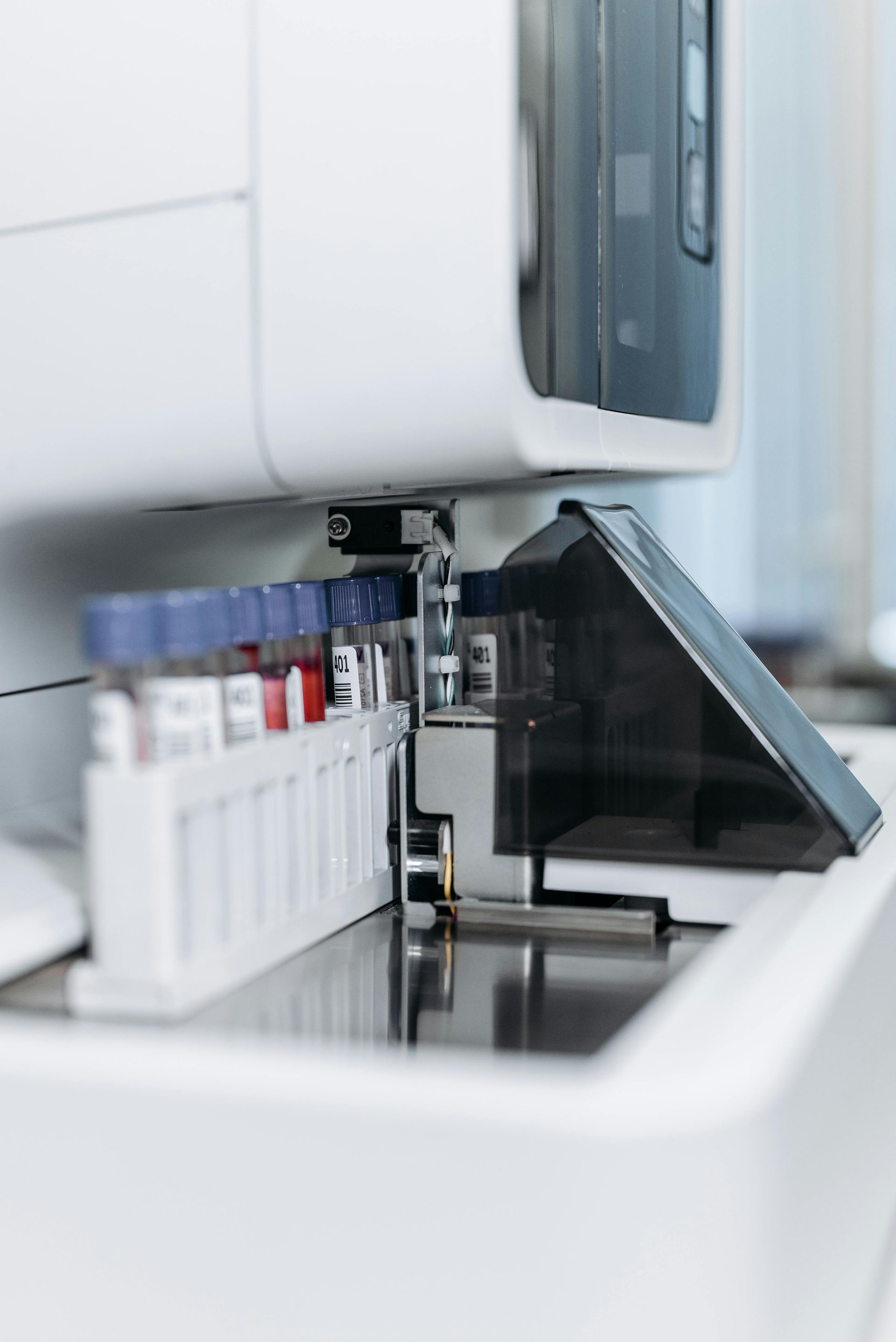

Lenders finance trucks, machinery, restaurant equipment, medical devices, and specialty tools based on the asset's value and your business credit profile. Approvals often close in days rather than weeks, and many programs require minimal financial documentation beyond recent bank statements and a basic business profile. This structure works especially well for businesses that need to move quickly on equipment deals or take advantage of seasonal demand spikes.

Request an equipment quote today to understand funding options and add the tools you need in Lake Worth.

Details That Matter Most

Your financing starts with a quick application that covers the equipment type, purchase price, vendor details, and basic business information for your Lake Worth operation. Lenders evaluate the asset's resale value, your time in business, and recent revenue to determine approval and payment structure. Most programs finance 80 to 100 percent of the purchase price, and terms typically range from two to five years.

Alternative Lending Services LLC provides financing solutions for trucks, machinery, restaurant equipment, medical devices, and specialty gear. Strong lending background allows tailored recommendations based on cash flow and operational needs. Approvals often arrive within 24 to 48 hours, and funding transfers directly to the vendor once paperwork is signed.

You also receive support evaluating lease-versus-purchase options, payment timing, and tax benefits tied to Section 179 deductions. This guidance helps you choose the structure that protects cash flow while maximizing equipment value over the life of the asset.

Business owners in Lake Worth often ask about approval speed, down payment requirements, and how lenders handle older equipment or specialty tools that don't fit standard asset categories.

Why Locals Choose This Option

Whether you're adding a new truck to your fleet or upgrading kitchen equipment for a busy season, you deserve financing that moves quickly and fits your cash flow. Connect with us now to request a no-obligation equipment quote and start building capacity in Lake Worth.