OUR FUNDING PARTNERS’ CREDENTIALS

GET FUNDED IN 1-2-3 EASY STEP

Checking your rate won’t affect your credit score

Apply Online

Fast & Easy Online Application Our loan specialist will contact you Or call us at our phone number: (561) 860-0450

Review Your Options

You will have options to get funding in minutes

Funded

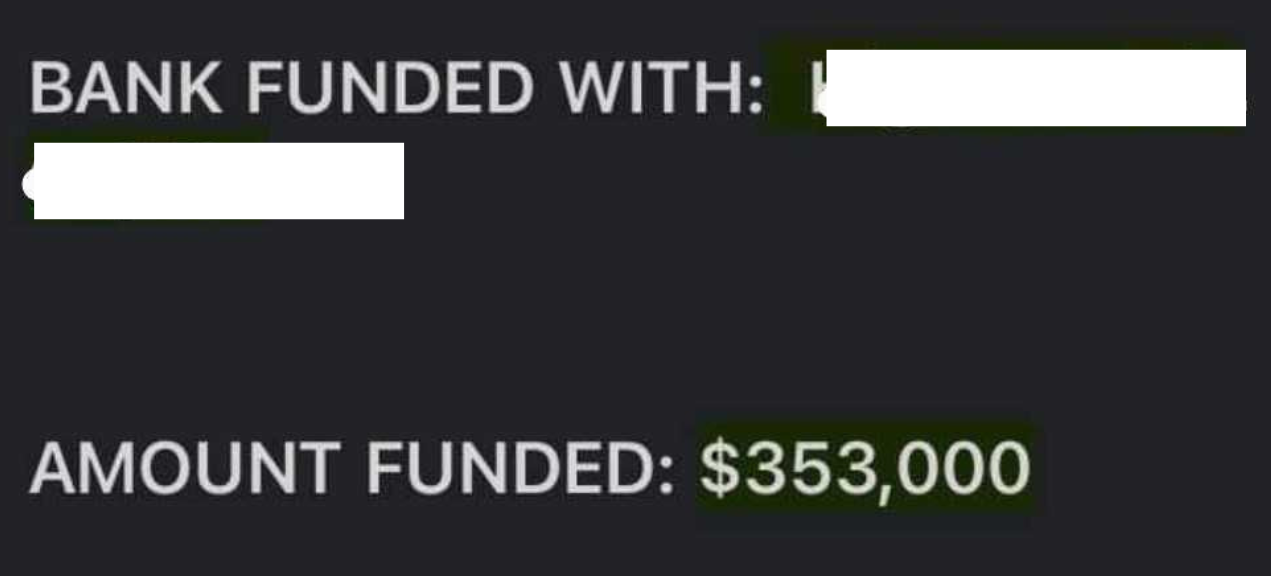

Loans – $5,000 – $5,000,000

Receive funding in as fast as 1 day

FAST, EASY, RELIABLE

10,000 +

Business Served

$2 Billion +

Funds Delivered

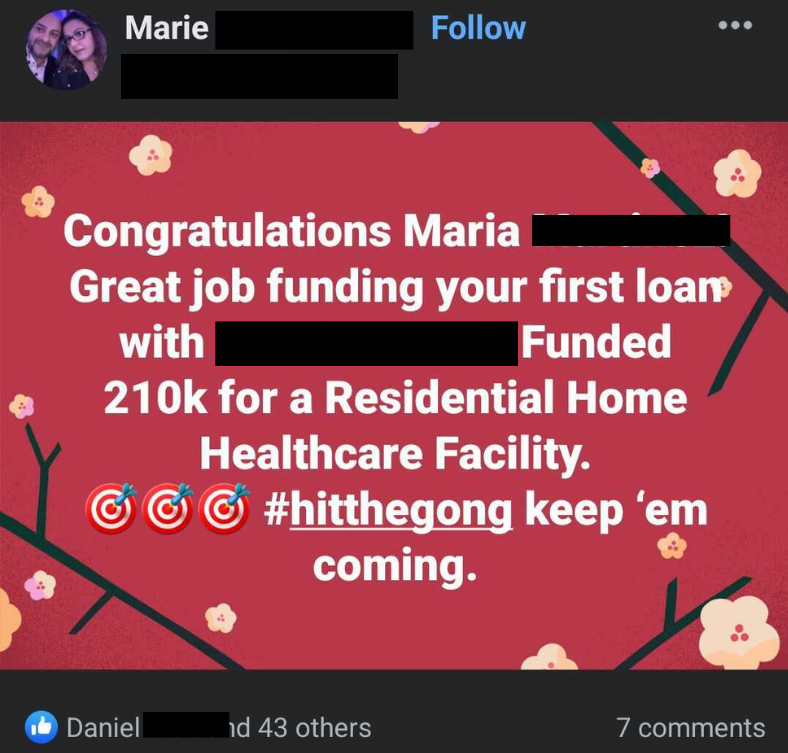

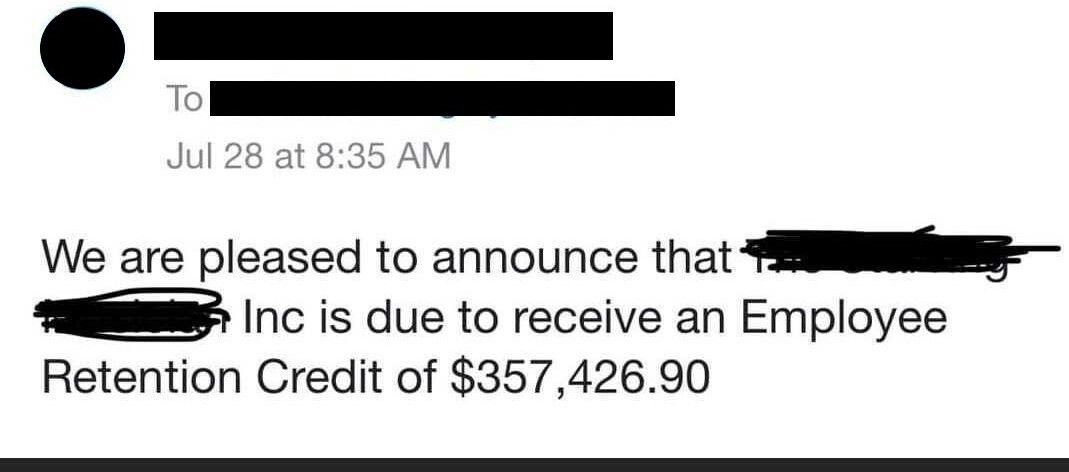

Customer Reviews

Unlock Funding That Fits Your Goals

Find Reliable Lending Services Nationwide

Alternative Lending Services LLC connects business owners and real estate investors Nationwide with financing programs designed for speed, flexibility, and real-world application. Whether you're closing on a rental property, launching a renovation, or scaling operations, you'll work with a broker who's navigated these decisions firsthand.

You'll benefit from a consultative approach that prioritizes clarity over complexity, with competitive programs that align to your timeline and investment strategy. Each loan structure is matched to your cash flow, project scope, and growth objectives, ensuring you're set up for sustainable progress. Clear communication and direct guidance are standard throughout the process.

Alternative Lending Services LLC brings local insight across Lake Worth and surrounding Florida markets, with familiarity in regional housing trends, commercial development, and small-business dynamics. You're not working with a call center—you're partnering with a broker who understands both the lending landscape and the investor mindset that drives profitable decisions.

Reach out today to discuss financing options tailored to your next project Nationwide.

Fix & Flip

Short-term capital tailored for renovation projects with flexible terms and quick turnaround.

Equipment Financing

Purchase or upgrade essential tools and machinery to keep your business operations running smoothly.

SBA Loan

Government-backed funding designed to help small businesses grow with competitive rates and extended terms.

Our Service Area

List of Services

Experienced Guidance You Can Trust

Work directly with a broker who understands both lending requirements and investment realities.

Every funding need is different, and your financing should reflect that reality. Our full suite of lending options includes:

Comprehensive Financing Solutions for Investors and Business Owners

DSCR Loan programs for rental property investors seeking cash-flow-based approval without income verification

Fix & Flip Financing with flexible terms designed for renovation timelines and resale strategies

Equipment Financing to upgrade tools, machinery, or operational assets that keep your business competitive

Working Capital, Term Loan, SBA Loan, Business Line of Credit, and Multifamily Funding tailored to Lake Worth markets

Connect with us to explore financing solutions built for your investment goals in Lake Worth.

Schedule a Consultation

Contact Us

We will get back to you as soon as possible.

Please try again later.

Why Investors and Business Owners Choose Us

Alternative Lending Services LLC is backed by decades of combined lending experience and hands-on real estate investing in fix-and-flips, DSCR properties, bridge loans, multifamily, and commercial projects. Local familiarity with Lake Worth's housing growth, commercial development patterns, and small-business environment means you're getting advice grounded in market realities, not generic underwriting templates.

You'll experience a consultative, investor-minded approach that goes beyond paperwork—your broker understands the challenges of capital timing, deal structure, and portfolio scaling. Transparency, responsiveness, and personalized service define every interaction, so you can move forward with confidence.

Call today to discuss fast, personalized funding solutions Nationwide with a broker who understands your goals.

Phone

Location

Lake Worth, FL

33467

Hours

- Mon - Fri

- -

- Sat - Sun

- Closed

TRUSTED PARTNERSHIPS

WITH OVER 50+ LENDERS

EXCLUSIVE PARTNERSHIPS

THAT YOU CAN COUNT ON

At Alternative Lending Services, we appreciate how investing in relationships brings mutual prosperity. Who we partner with ensures the best services available for our customers.

To discuss potential opportunities, please call

(561) 860-0450